THE PAYMENT OF BONUS ACT 1965

The Payment of Bonus Act, 1965 is the principal act for the payment of bonus to the employees which was formed with an objective for rewarding employees for their good work for the organization. It is a step forward to share the prosperity of the establishment reflected by the profits earned by the contributions made by capital, management and labour with the employees.

Objective

Objective

- To improve statutory liability to pay bonus [reward for good work] in case of profits or losses.

- To prescribe formula for calculating bonus

- To prescribe Minimum & Maximum percentage bonus

- To provide of set off/set on mechanism

- To provide redressal mechanism

What is a bonus?

The bonus is a reward that is paid to an employee for his work dedication towards the organization. The basic objective to give the bonus is to share the profit earned by the organization amongst the employees and staff members.

What is Payment of bonus Act?

In India, there is a principle law relating to the procedure of payment of bonus to the employees and that law is named as Payment of Bonus Act, 1965.

The Payment of Bonus Act applies to every factory and establishment which employs not less than 20 persons on any day during the accounting year. The establishments covered under the Act shall continue to pay the bonus even if the no of employees falls below 20 subsequently.

Note: Bonus is to be paid within 8 months of closing the book of accounts.

Payment of bonus act applicability

The payment of bonus act applies to the whole of India. The Provision of this act applies to the following factories / establishments / companies:-

- The factory defined under clause section 2 of the factories act 1948.

- Every establishment in which 20 or more persons employed on any day during an accounting year.

- The act also applies to public sectors in some cases.

- Part-time employees also included.

When is the employee eligible for the bonus?

Every employee drawing not less than Rs. 21,000/- per month and who has worked for not less than 30 days in an accounting year shall be eligible for the Bonus. Every employee will be entitled to be paid by his employer in an accounting year, bonus, in accordance with the provisions of this Act, provided he has worked in the establishment for not less than 30 working days in that year.

When an employee is not eligible for the statutory bonus but the company wants to share bonus, it can be given as ex-gratia.

Minimum Bonus

Previously, the maximum bonus payable was 20% of Rs 3500 per month. The minimum bonus payment was capped at 8.33% of Rs 3500 per month or Rs 100, whichever is higher. The calculation ceiling of Rs 3500 is currently doubled to Rs 7000 per month “or the minimum wage for the scheduled employment, as fixed by the appropriate Government” (whichever is higher). Therefore, the cost associated with bonus payments could be double, based on the organization’s performance.

Calculation of Bonus as per Bonus Act (Amendment of 2015)

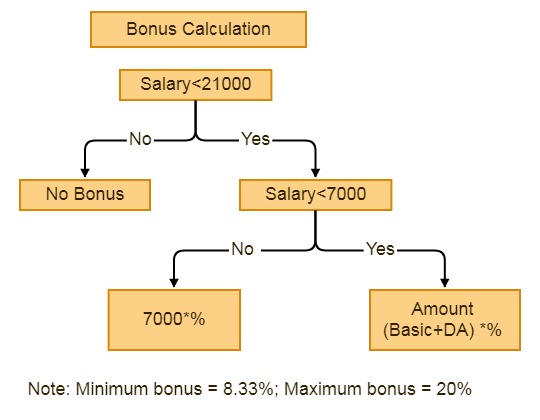

If the gross earning of your employees is below Rs.21000 you are eligible to pay bonus. Calculation of bonus will be as follows:

- If Basic+DA is below Rs.7000 then bonus will be calculated on the actual amount.

- If Basic+DA is above Rs.7000 then the bonus will be calculated on Rs.7000.

Examples of calculation of bonus

- If the Basic salary of the employee is less than or equal to Rs 7,000

Rahul is working as an engineer in a Company in Bangalore. His basic salary is Rs. 6,500 per month.

Formula: Basic Salary*8.33% = Bonus per month

6500*8.33% = 541.45 (6497.4 per annum)

- If the Basic salary of the employee is higher than Rs 7,000

Siddharth is working as a Sales officer in one of the shops in Delhi. His basic salary is Rs. 18,000 per month.

Formula: Basic Salary*20% = Bonus per month

7,000*20% = 1400 per month

- If the Basic salary of the employee is higher than Rs 21,000

There is no bonus applicable to employees having a basic salary of more than Rs 21,000.

Exempted establishments

The payment of bonus act will not apply to the following section of employees:

- The employees of Life Insurance company

- Seamen defined under clause 42 of the merchant shipping act 1958.

- Employees who registered or listed under the dock workers Act 1948 and employed by the registered or listed employers.

- The employees of any industry controlled by central or state government.

- Employees from Indian red cross society or education institutions, institutions not for profit.

- Employees employed by the contractor on building operations

- Reserve Bank Of India(RBI) employees

- Employees of any financial corporation under the Section 3 or Section 3a of the State Financial Corporation act (SFC) 1951

- Employees of IFCI, Deposit Insurance Corporation, agriculture Refinance Corporation.

- Any financial institution is an establishment in public sector which central government notifies.

- The employees of inland water transport establishment